I love the fact that websites and website portfolios are becoming a legitimate investment vehicle. That drives up demand for websites which increases valuations.

In recent years, website portfolio owners have been doing just that… offering investment opportunities to outsiders. It’s an interesting concept. I decided to run some mock scenarios based on my current portfolio.

What is investing in a website portfolio?

It’s similar to investing in a fund that holds investments in a variety of companies usually in the form of having purchased stocks in various companies.

Instead of buying into a pool of companies, you’re buying into a pool of cash-producing websites.

It makes sense that such an investment exists. After all, websites produce cash flow. Anything that produces cash flow offers investment opportunities.

The question is whether you should offer your website or portfolio of websites into an investment opportunity for investors. The other side of the analysis is whether it makes sense to be a passive investor in website portfolios.

Note that I’m not a financial analyst or all that knowledgeable about investing generally. I’m looking at this through the lens of someone who knows website publishing.

Here it goes.

2 types of website portfolio investment opportunities

- Preferred shares with hopeful dividend payment (basically borrowing): In this situation, the investment vehicle proposes a set annual return. You get your initial investment amount returned to you at a specified time or upon request according to whatever terms you agreed to. Basically, it’s borrowing money.

- Equity investment: Your investment garners you a percentage of the entire portfolio of websites. If the value goes up, your investment grows. If value goes down, your investment suffers. If the portfolio pays out dividends to your class of shares, you receive an income plus retain a percentage of ownership in the sites.

Why offer your online publishing business as an investment opportunity?

The short answer: To get your hands on more capital for faster expansion and building out a bigger online publishing business.

Which type is best?

Both can be good and bad.

The best way for me to do this analysis is to use my small portfolio of 2 websites as an example. This serves as both an example of whether it’s a sound investment and whether it’s worth offering as a website portfolio owner.

My current website portfolio performs as follows (Fat Stacks not included and numbers rounded for simplicity):

- Monthly net income: $50,000

- Annual net income: $600,000

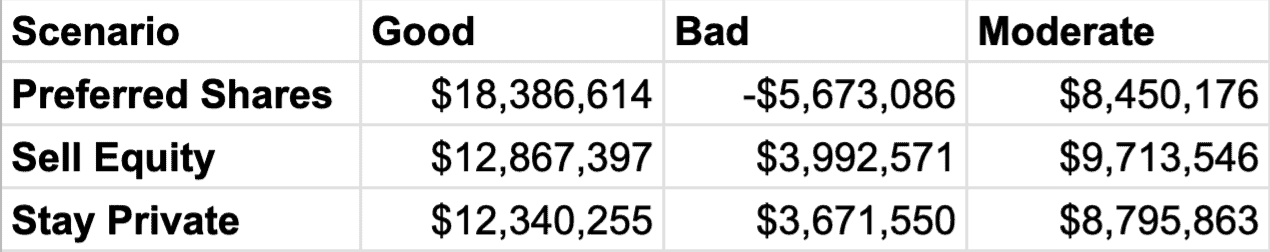

SUMMARY

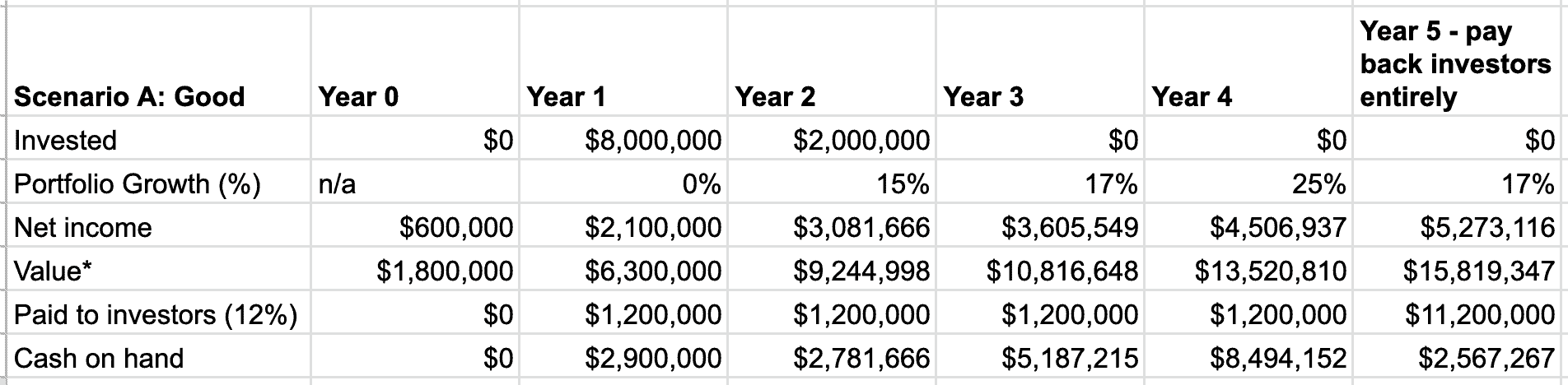

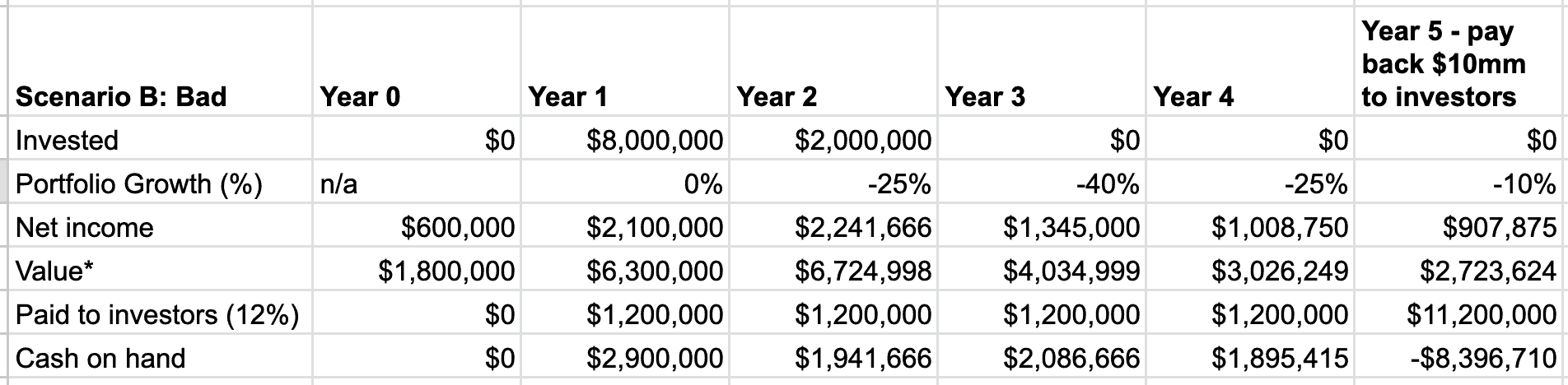

The scenario is as follows:

- Amount raised: $10 million.

- Timeline: 5 years.

- Promised return to investors: 12% paid annually.

- Equity given up: None.

- Initial investment returned to investors at the end of year 5. In this case, it’s a payout of $10 million on top of the annual 12% paid out.

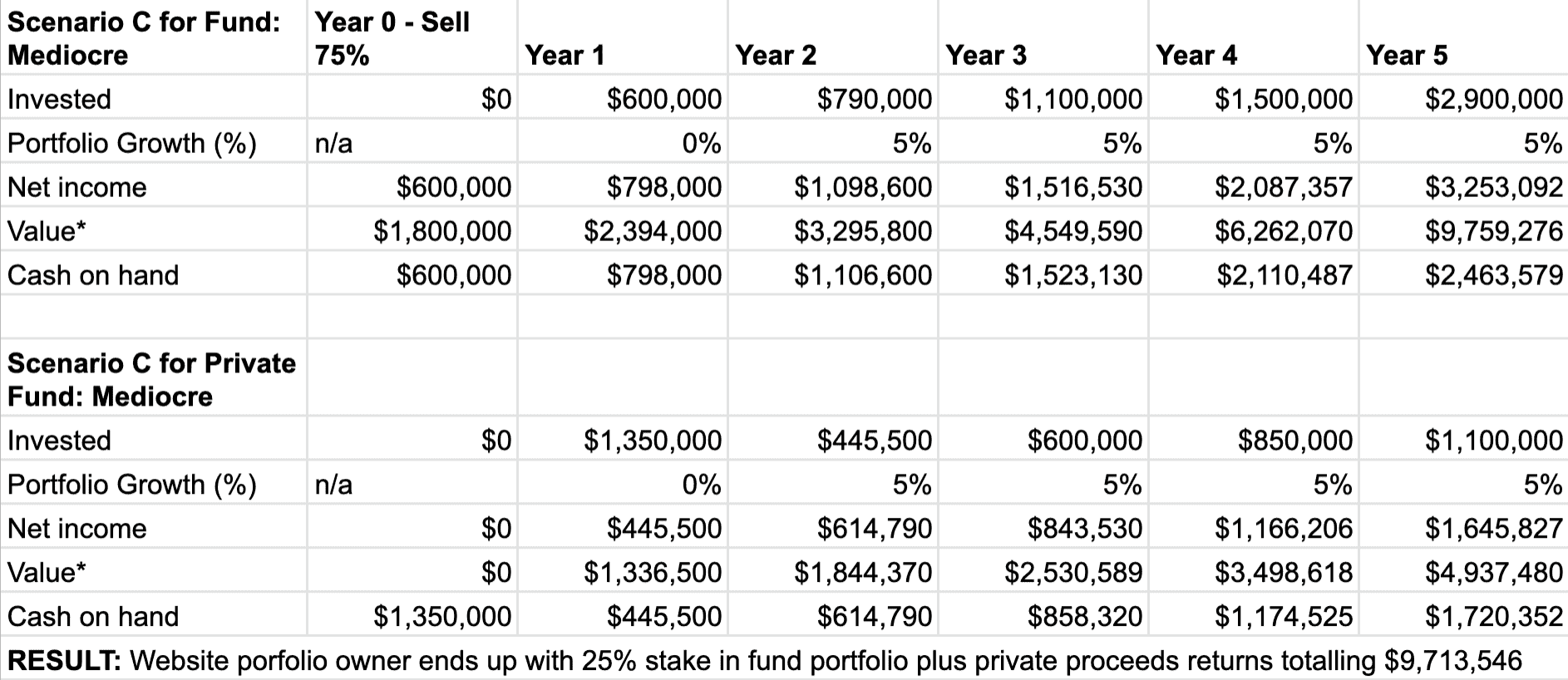

Sell Equity Scenario

Let’s assume that instead of essentially borrowing money, I decide to sell equity to fund growth.

- Amount of equity sold: 75%

- Amount raised based on current portfolio valuation: $1,350,000

- Analysis timeline: 5 years

This scenario is more complicated because the $1,350,000 raised from selling equity would be held and invested entirely by the portfolio owner. Hence the two sets of tables for each outcome scenario below.

So basically, website owner gives up 75% of portfolio for $1,350,000 which is used to buy other web properties outright.

I suspect in reality that selling equity could result in a higher multiple for the valuation but I want this analysis to be fairly conservative.

RESULT: Website portfolio owner ends up with 25% of fund plus private proceeds amount totaling $3,992,571

Stay Solo with Own Portfolio

Finally, I’ll wrap this up with the scenario where I keep my portfolio private. Note that the assumption here is that I reinvest the lion’s share of the net income. While I do reinvest annually, it’s less than the amount set out in the analysis. I tend to invest some of the proceeds in non-web investments such as mutual funds.

Notes:

* Site valuations based on a 36X net monthly income.

The invested row means reinvestment back into the portfolio… specifically acquiring more web properties and reinvesting into existing web properties.

The above analysis does not take into account increased costs that would be incurred for lawyers, accountants and website managers. Moreover, any investment vehicle will incur significant legal fees.

Analysis / Comments

The above analysis is partly skewed because it assumes reinvesting almost all of the proceeds which is unrealistic given folks would require money to live on etc.

Borrowing is both the riskiest and the opportunity with the biggest upside for the portfolio owner. I didn’t expect this until I crunched the numbers.

Selling equity is not an option unless you have an existing website or websites spitting out consistent cash. Raising funds via preferred shares is possible without cash flow if you can convince investors to take a chance on you.

A huge assumption is the ability to find and buy good web assets with the funds. This could be a tall order especially if spending $10 million.

If you offer an investment opportunity you give up a lot of control and are subject to the SEC and other regulatory bodies. This is a big reason I’m not interested in this unless the offer was too good to refuse.

An interesting aspect to note is just how important it is to reinvest as much of the proceeds as possible. This is what contributes to growing the value of the portfolio significantly. This is particularly noticeable in the third analysis (keep the portfolio private) under the 7% annual growth. Notice the big valuation after 5 years simply by reinvesting much of the proceeds.

Most important: The key for any of this is to manage the web properties well and keeping costs reasonable. And to do this at this scale requires the ability to hire and train excellent managers. If you can do this, the sky is the limit… that is unless Google decides to royally kick you to the curb which is the biggest risk in this business.

Jon Dykstra is a six figure niche site creator with 10+ years of experience. His willingness to openly share his wins and losses in the email newsletter he publishes has made him a go-to source of guidance and motivation for many. His popular “Niche site profits” course has helped thousands follow his footsteps in creating simple niche sites that earn big.