Have you watched the TV show Silicon Valley?

If not, give it a shot. It’s hilarious.

There’s one bit where a hired-gun CEO for a tech start-up that just received venture capital funding asks the founder what is the Pied Piper product?

Watch:

Some bloggers and niche site owners share the CEO’s perspective in that starting and growing a site is all about the exit price. Build up the net income as high as possible, then sell for nice chunk of change.

I too plan to sell my niche sites at some point.

The question is: When should you sell? Should you accept, for example, a $1 million offer?

Before you jump at some 5, 6, 7 or even 8 figure offer for your website, you need to consider the following.

How much do you need?

Let’s say you get a $1 million dollar offer for your website. Sounds sweet, right?

The fact is $1 million isn’t what it used to be.

If you live in the US, Canada or any other high-cost country, chances are you will need to make more money in the future. It’s unlikely, unless you are extremely frugal, that you can be finanically secure with $1 million. Even a $2 million sale probably won’t do it.

First, the broker involved will get a chunk. Something in the realm of a 15% commission payable by the seller (just like real estate).

Second, you will owe taxes on that money unless you actively reinvest it. Of course, the amount of tax can vary greatly, but if you end up paying it out as personal income, the tax bill will be huge. At least 30% (I have no idea what personal income taxes are in the US). In Canada, it’s much higher than 30%.

Even at 30% plus the broker’s 15%, you pretty much lose almost 50% of the sale price before you see a nickel.

That $1 million is now $550,000.

Here’s the troubling aspect of the equation.

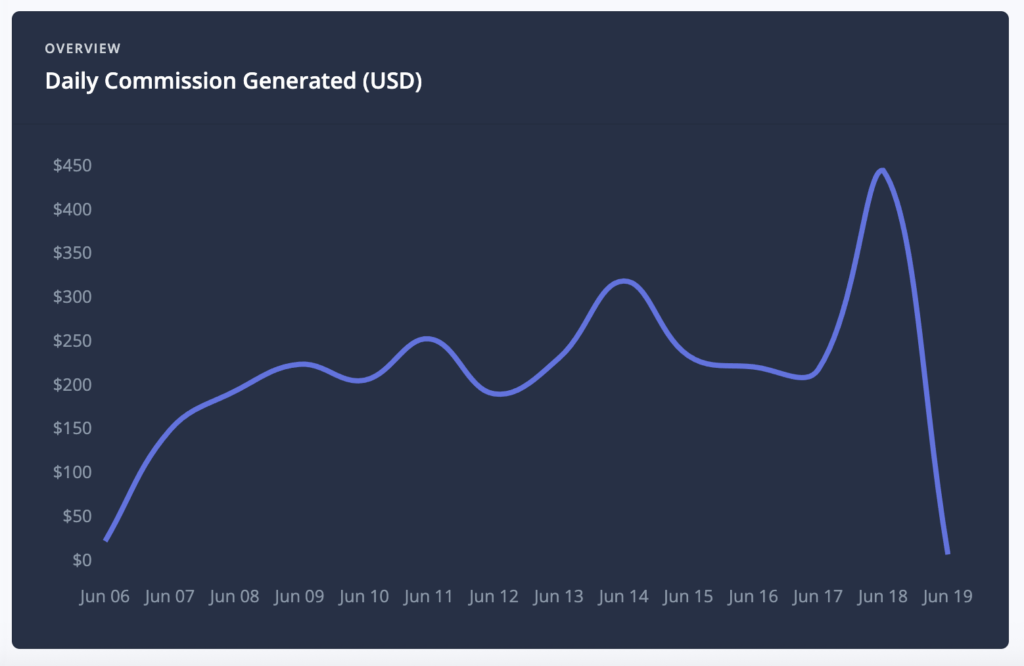

In order to fetch a $1 million sale price, your site needs to earn around $33,000 per month. That’s a 30 net monthly income multiple which is pretty good.

UPDATED PORTION: THANK YOU TO COMMENTERS POINTING OUT A GLARING MISTAKE I MADE:

I failed to mention that if you keep the site, you will also pay taxes on that income each month. However, maybe a higher percentage of that income will fall under a lower tax bracket if your tax code is progressive (higher tax % on higher incomes).

Another point that was made is if you sell, the sale proceeds could qualify as a capital gain which may be taxed at a much lower amount.

You can see from the situation that it’s important to get tax advice on this when deciding between selling and keeping a site.

– END OF UPDATE –

Here’s the $1 million dollar question: Would you rather have $550,000 now or $33,000 (less taxes) per month indefinitely?

Of course, that’s simplistic, but if you have no idea what to do with the sale proceeds, you may end up broke as a joke because $550K won’t last long unless you truly are frugal and have a personal finance plan with that money.

If after taxes you are certain you’re financially secure, then all bets are off.

You will want to consult a personal finance expert to confirm this, but if you believe the sale prices, after broker commissions and taxes, that you can conservatively invest the remaining sale proceeds and live off the returns, then go for it.

You need to be sure though, especially if you’re still young (inflation decreases spending power quickly). It’s not a simple calculation.

You also need to take into account potential lifestyle changes. If you don’t have kids now but will later, be prepared to need a lot more money.

I’m no personal finance expert, but I’ve read that you can reasonably expect a 7% return on money passively invested in a diversified manner (i.e. stocks and bonds).

That means with $550,000 sale proceeds, you would earn $38,500 per year. However, over time, unless you plow more into the invested funds, inflation will effectively decrease your income year after year.

Yeah, it’s complicated.

In all likelihood, if you have a house, kids, a car and enjoy vacations and the odd restaurant meal, you’ll need at least $60,000 per year (more in some areas like California or Vancouver).

To earn $60K per year from investments, you need to have approximately $1 million invested. That would require a website sale price of almost $2 million. After taxes and fees on a $2 million sale, you’d have a tad over $1 million to invest.

I could go on and on.

The point is what may seem like a lot of money, necessarily isn’t.

Taxes

I mentioned it above, but it’s a huge consideration. Even if your business is incorporated, there will be a tax bill on the sale proceeds unless you can actively reinvest that money into a revenue-generating project.

There’s risk hanging on to a site

We’ve all read stories of websites losing traffic and plummeting in value as a result of traffic sources drying up. There are Google penalties/algo updates, FB did a number on many sites in early 2018 by reducing reach… anything could happen.

Yes, anything could happen. If you reject a $1 million dollar offer and then your site ends up worthless, you’d be kicking yourself forever for turning down that money.

This is a huge risk you face and is worth considering.

Do you have other revenue streams or realistic opportunities?

Suppose you have 4 niche sites, all of which earn well but you’re stretched too thin time-wise or resources-wise. In this case, selling one for $1 million to free up cash to invest in the remaining 3 may be a very good decision.

Perhaps:

- you’re tired of the $1 million site, or

- it’s plateaued, or

- you enjoy your other sites more and see more potential with them.

Assuming the remaining sites kick off sufficient revenue for you to stay in business, selling may be an outstanding decision. You can do a lot for a blog with $1 million.

Or, perhaps you want out of the blogging business and need cash for a different type of business. That is certainly a good reason to sell.

Putting it all together

The following criteria applies to me in the decision process of whether to sell or not:

When to sell:

1. The net proceeds after taxes and fees will meet my needs. Whether that need is to pay off debt, buy a house or ensure financial security (live off passively invested income). Sometimes meeting a financial need or goal is the most important outcome. For me, at this point, given how much cash my sites kick off each month my need is enough money to live off of from passive income (stocks and bonds).

2. Sound investment opportunity with the proceeds. Suppose you have other sites that have real promise or another sound business opportunity… selling could be the best decision.

3. Website is distressed: Many website owners sell sites when distressed. Perhaps they are doing worse than before, the potential is not as good, etc. Of course a buyer will price this into the equation, but buyers look for distressed sites all the time because they may view it as an opportunity.

My decision:

Since the $1 million is not an amount I need for my current financial goals, it doesn’t meet the need test.

Moreover, if I received $1 million, I have no investment opportunity for it other than passive investments. While investing passively is great and it’s something I do, I still need an income to survive. The passive income would not be sufficient income.

Yes, I could invest in more websites, but that kinda defeats the purpose. I have other niche sites, but they’re growing with current revenue reinvestment. Throwing $200K or some ludicrous amount at them would probably be a waste of money. Therefore, I might as well keep the site until I have other opportunities and/or the sale price does meet my financial need/goal.

Under distress: I’ve had sites become distressed. It’s not fun. When it happens, you’ll take almost anything just to be rid of them hoping a buyer sees an opportunity. Fortunately, my site is not under distress so that rules out selling for that reason.

Don’t pull a Kramer

Don’t pull a Kramer. Remember the storyline where he sued a coffee company for burning his crotch carrying a cup of coffee into the movie theater inside his pants?

Watch what he does:

Jon Dykstra is a six figure niche site creator with 10+ years of experience. His willingness to openly share his wins and losses in the email newsletter he publishes has made him a go-to source of guidance and motivation for many. His popular “Niche site profits” course has helped thousands follow his footsteps in creating simple niche sites that earn big.

I agree with you, except if you compare the monthly earnings from the lump sum you receive after tax, you should compare it to the monthly income after tax. Otherwise you are not comparing apples with apples.

It is a good discussion and selling one site when you have a few is a good way to diversify your asset risk portfolio, but you’ll probably always wonder how much money you are leaving on the table.

Hey Noline,

Yes, you’re absolutely right and this occurred to me last night. This goes to show you how important it is to consult professionals with these matters.

Totally agree. I’ve turned down a bunch of offers for selling sites for the same reasons.

Just one thing – I may have skipped when reading – when you calculate your potential revenue from keeping the site you should also keep taxes in mind. With a single huge payment, your tax bracket may be higher, or it may not. Depending on the tax laws where you live and how good your accountant is.

Hi Anne,

Yes, you are right about taxes payable if you keep a site too. I will update the article. This is why I hire accountants and if I were serious about any offer of this magnitude I would consult them before doing anything.

If you don’t sell the site you’re still going to have income taxes on the $33,000 per month. Also, if you’ve owned the site for more than a year it can (check with an accountant) be taxed as long term capital gains when you sell, which is typically lower than what you would pay on income tax – at least, that’s in the US, I don’t know about Canada.

I haven’t sold a site for a $1 million, but I have sold 4 sites for anywhere from $200,000 – $500,000, and I don’t regret any of those sales, but it’s obviously a decision that will be different for everybody.

Hey Marc,

great points. I’ll update the info regarding taxes. The point being is get tax advice. Taxes are different in each country and it’s also different whether you keep the cash in a company or whether you operate as a sole proprietorship and pocket the cash as personal income.

When you sold those sites, did you have a reinvesting plan for the cash? Or is that your business model – build up sites for a 6 figure sale and then sell… rinse and repeat?

I didn’t re-invest much at all. That’s kind of been my business model.

Great post Jon, fees and taxes can really sour an exit. As a big part of my business is building sites to flip my accountant treats a sale as general business income and I don’t think we get the same tax benefits here in UK which sucks.

However the sites I build / partner on as an operator are content / affiliate sites dependent on organic traffic and I’m all too aware that any google update can reduce traffic by 20% overnight. I therefore look to hold sites for the minimum amount of time possible when flipping. Cheers!

Hey Richard,

Yes, you present a very good point. As risky as it is selling and needing to invest in another revenue stream, it’s certainly not risk-free hanging onto the site. I’m one algo update away from losing lots of money (we all are). It happened to me in April 2012.

Or you can sell this one, then buy a different, more passive, more stable site and earn 40% ROI on it. Or even buy one with more room to grow. For example, let’s say you take that $550k and invest it into another website, this one gets you around $20k per month. Maybe it has room to 2x where your current site doesn’t? Or maybe it’s more stable/less time intensive than the current site.

Hey Dom,

Yeah, those are very good considerations that crossed my mind. Interestingly, I received another inquiry about selling today.

The site in question is fairly labor intensive even with VAs and writers, so your point about finding a site with decent current earnings with strong growth potential that’s easier to run is an attractive option. There are definitely sites easier to run. I have other niche sites that I barely have to look and it makes a big difference.

Moreover, if I planned to reinvest the money into another site, the tax bill would be much less, maybe non-existant since I’d be investing the funds into an active investment (of course I’d need to ask an accountant this). If the tax bill is less, that leaves more to spend on a good site.

2 things hold me back right now from your suggestion:

1. There’s no guarantee I’d find the right site to buy for me and my operation.

2. I have a good thing going. Buying a site for that much money is risky. I could very well mess it up. I’d probably need to hire someone to do due diligence since that’s not something I have experience with.