As a freelancer, you are responsible for every aspect of your business—increasing traffic, getting clients, making money, etc. With the mounting pressure to take on more projects and improve your craft, there’s no way bookkeeping is high on your radar.

We don’t blame you. Bookkeeping is inherently dull after all.

The problem is, without accurate books, you won’t have an accurate view of your financial standing. Accounting provides a snapshot of your company’s financial viability and records that are outdated or inaccurate create a “snapshot” that is out of focus.

So while we admit that bookkeeping isn’t necessarily fun, making a profit is, and so is getting money back at tax season instead of owing. This kind of “fun” financial data can only come from accurate books.

Bookkeeping for Bloggers

The primary function of a bookkeeper is—as you might guess—“keeping the books” for a business. As a blogger, you will be managing the books (aka financial records) for your own business. The goal of bookkeeping is to produce accurate and up-to-date financial statements that show you exactly where your business has been and where it is now.

Bookkeeping is different from accounting. In fact, it’s is more of a subset of accounting. Accounting encompasses all tax preparation, business auditing, and other forms of financial analysis. Bookkeeping primarily focuses instead on two basic tasks: categorization and reconciliation.

Categorization

Every transaction that pertains to your business needs to be categorized. Transactions that have been correctly categorized—books that have been accurately “kept”—produce reconciled accounts and up-to-date financial statements.

Categorization starts with a “Chart of Accounts”: the group of categories you’ve created for your business transactions. Accounting software products typically create default categories and subcategories for you (e.g. “Assets” and “Accounts Receivable”), but you can always customize as well.

Your Chart of Accounts has multiple levels. For example, while you might categorize a transaction as “Supplies,” that transaction would fall under the parent category of “Office Expenses,” then “Expenses” and finally “Owner’s Equity.”

What you need to know is that your categories/accounts will ultimately be reflected on your financial reports and your taxes. Choosing the correct category is essential, so that you can get all of your write-offs and don’t overpay.

This is what categorization looks like in ZipBooks. Transactions have been imported automatically from a credit card, but it’s up to you to categorize them. You’ll notice that on some of the transactions, our AI-powered software has suggested a categorization with a percentage next to it. This number is our “confidence score,” indicating how confident we are that we got the category right.

ZipBooks learns about your trends in spending, the way you record transactions, and how you categorize each entry—then, we take a guess at categorization, making your job easier! If you find that something’s categorized wrong, simply make a correction, and ZipBooks will learn from its mistakes.

Reconciliation

As you categorize your spending, you will also reconcile transactions. Reconciliation guarantees that your accounting records match up with your bank statements (both beginning and end balances).

In the past, reconciliation was done with pen and paper, creating accounting ledgers or books. Then, it upgraded to the spreadsheet. Now, modern accounting software eliminates the need for any manual data entry.

Cloud-based accounting products seamlessly sync with your bank, pulling in every transaction automatically. All you have to do is file each transaction in a category, then verify that it really happened (or reconcile it). On occasion, the syncing systems aren’t perfect—either the bank connection was off or someone in the accounting system did something wrong. This is why we reconcile.

Reconciling in ZipBooks is easy. The box at the top shows you how your books (ZipBooks) and bank balance (Plaid Premier Checking) compare. This helps you know exactly how far you are off ($987 in this example). This gives you an easy starting point to know how far you have to go—it might even be a single $987 transaction that you’re missing!

Next, you match up every transaction to your bank statement by clicking the checkmark on the right. At the end of that process, if the balance was “off” to start with, reconciliation helps you to find any missing, duplicated, or incorrect transactions, and fix them.

As a note: if you haven’t done so already, please please please separate your business and personal spending. If you don’t, reconciliation will be a nightmare. To separate spending, you don’t have to do anything fancy—just contact your current bank and open a second account exclusively for business transactions. Then, your business’ income and expenses will be easily traceable and all in one place.

Timeliness

Now that we’ve dug into the nitty gritty, let’s get back to the basics. Where even the most experienced business owners fall short is timeliness. Bookkeeping can be straightforward, even easy, if you do it right away.

Commit to regularly maintain your books and the task will only take a few minutes here and there rather than hours or days at a time.

Put bookkeeping in the calendar. Make it part of your weekly routine. Set an alarm on your phone. Procrastinating your books will only cause you to dread doing them even more—a vicious, costly and time-consuming cycle.

If you are more than six months behind, consider contacting a professional bookkeeper to help you get caught up. Forgive yourself for your accounting mess and get to work. Bookkeeping does take time and resources, but if you can stay on top of it, it will never drag you down too much. Instead, bookkeeping will help inspire your financial growth.

Taxes

While financial reports are a boon to your business, what many freelancers want to know about bookkeeping is how it applies to your tax requirements and deductions.

Small business owners and freelancers are subject to the self-employment tax, which can also include making estimated quarterly payments. Stay on top of your tax calendar so you don’t incur any late fees or penalties for missed payments.

Freelancing does have its tax benefits as well. If you have kept accurate records year round, you will be able to deduct business expenses (including travel, office space, equipment, etc.) by using a Schedule C (Form 1040). Remember that you will need to provide concrete evidence that these write-offs actually apply to your business, which proper bookkeeping will provide.

Other helpful definitions

When you’re doing your own bookkeeping, it can be helpful to know a few other terms:

- Double Entry: The standard for accounting today, double entry bookkeeping enters every transaction in two places, as both a debit and a credit. If you have an intuitive accounting software, you won’t have to worry too much about how double entry works. Just know that it helps you get the most useful reports for your business.

- Accounting Equation: Assets = Liabilities + Owner’s Equity; In bookkeeping, this equation is always true. It is reflected on your “Balance Sheet.”

- Assets: Some sort of property that has value to the business (cash, inventory, accounts receivable)

- Liabilities: Debts owed by the businesses (loans, credit card balances)

- Owner’s Equity: Represents the owner’s (or an investor’s) claim on the business

Cloud-based Accounting Software

While all of that jargon may have sounded complicated, in today’s world, it doesn’t have to be. The days of shoe box filing and DIY excel spreadsheets are gone. Cloud-based accounting software is the bookkeeping solution bloggers have been looking for.

Cloud-based applications are the norm today and they are incredibly secure and easy to organize. These software products can be accessed any time of day, from any platform and receive automatic updates—this is particularly useful to freelancers who are always on the go.

Plus, many accounting products offer a free tier for bloggers, so take advantage of that!

Automated reports

The beauty is, if you’ve kept accurate books, most accounting products will produce financial reports for you. You don’t have to do any complicated math to view your financial standing. You just categorize transactions and let your software do the heavy lifting.

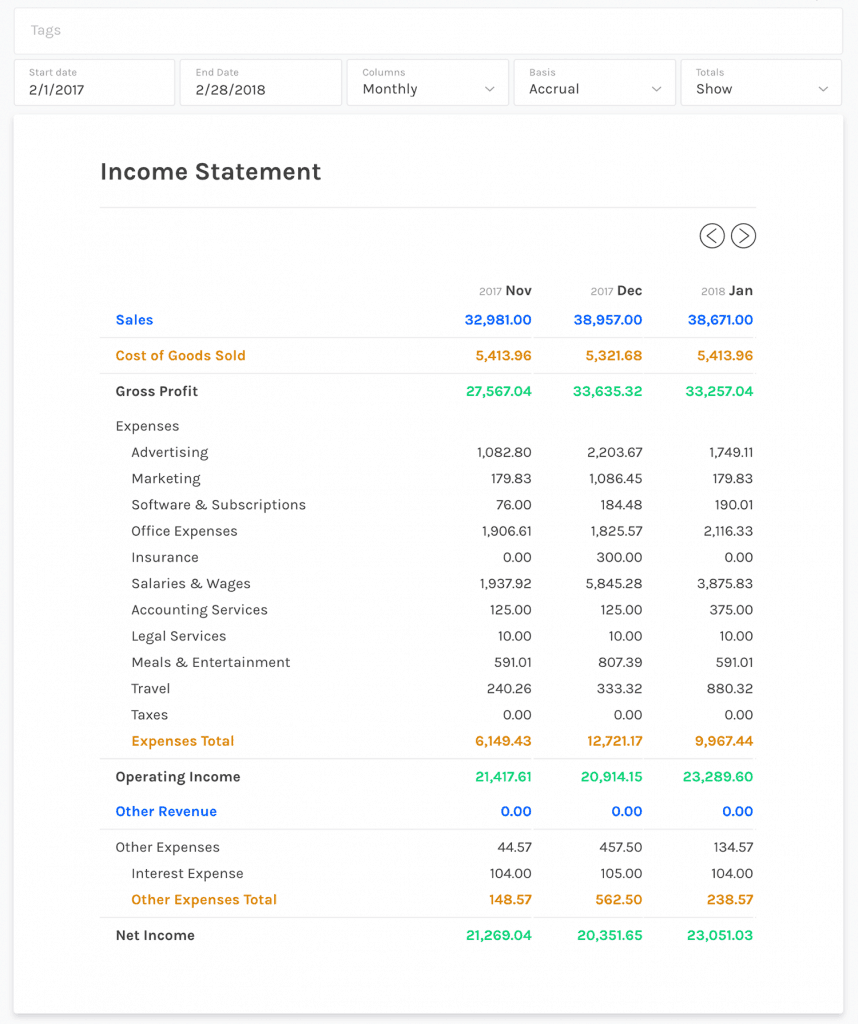

Here’s an example of an Income Statement produced by ZipBooks. We take all your categories, crunch the numbers digitally, and present them in a way that is useful to you. Profits and Incomes are color-coded and quickly identifiable, so you can see the data you need most, when you need it.

Let me mention the three reports that are of the greatest value to freelancers:

- The Balance Sheet: The Balance Sheet is called such because it expresses a “balanced” accounting equation (defined above). The total of your assets needs to equal the total of your liabilities and equity combined. If these numbers are not identical, you will have inaccurate books and file a faulty tax return.

- The Income Statement: While the Balance Sheet presents a moment in time, the Income Statement (or “Profit and Loss Statement”) shows your total sales and expenses over a specified period. Your net income, or the “bottom line,” is your profit, and it’s what you pay taxes on.

- The Cash Flow Statement: While profit is great, it doesn’t necessarily equal cash on hand. Your Cash Flow Statement combines data from the Income Report and Balance Sheet in order to give you a summary of your cash position.

Automated payments

Odds are, as a blogger, you accept most of your payments online. Whether you use bank transfer or a payment processor, cloud-based accounting applications are equipped to automatically sync your transactions with your books. This speeds up reconciliation!

For example, in ZipBooks, customers can conveniently pay directly from their invoice. This means less steps for them to make a payment, and you getting paid faster. These transactions are automatically entered into your accounting records—one less thing for you to worry about.

We also integrate with the major payment processors: Square, Stripe, PayPal, etc. This way, if customers already have a Square account and don’t want to enter their credit card information on your invoice page, they have the security and convenience of using a pre-established platform.

However customers choose to pay, your cash flow is benefitted from automated payments and cloud accounting software.

Automated invoicing

Most accounting software products will also allow you to link your invoicing to your books (and thus, link your payments as well).

This means that every invoice you send will be entered in your records as accounts receivable. When customers fill an invoice, your accounting software will know exactly where to categorize that income.

In addition, ZipBooks helps you to know how and when your invoices could be better. Your Invoice Quality Score is based on thousands of data points. We tell you which details matter and how to tweak them so you can keep customers and get paid faster.

ZipBooks also saves line items for faster invoicing, helps you track the status of invoices, allows you to set up recurring payments and sends automated reminders to late-paying customers.

Every business needs an efficient way to keep the cash coming in. The automation provided by cloud accounting products makes expediting invoicing cycles easy.

What about QuickBooks?

QuickBooks is by far the most recognizable name in the accounting software space. They have been building accounting solutions since 1983 and have expanded their initial Desktop offering to include Online alternatives, payment options, invoicing, and more.

Limitations of Desktop design

QuickBooks has been developing their Desktop software for decades, thus it’s bound to have some real power and research behind it. However, as we’ve explained, cloud-based accounting solutions are particularly useful to bloggers who are on-the-go, and need their accounting products to pack the same punch whether they’re at home or abroad.

While QuickBooks does offer an online solution, it’s an awkward re-hashing of their desktop package. You’re better off choosing a software product that was built on the cloud for the cloud. Cloud applications are updated continuously, in real time and come with 24 hour access and security.

QuickBooks 2019 plans start at $299 and QuickBooks Online pricing ranges from $10 to $150/month.

Enter ZipBooks

We formed ZipBooks with small business owners in mind, not just accountants. Thus, our interface is simple, intelligent and affordable. And not to mention, our software is free—forever!

Our starter plan includes everything you need—invoicing, accounting, contact management, simple reports, review gathering and publishing. For businesses looking to take the next step, we do offer paid accounting and growth plans starting at $15/month. But for freelancers, our free product will be more than enough to successfully manage your books and run your business.

We’ve already highlighted some of the features that we think make our product pretty cool, but we invite you to try it out for yourself!

Bookkeeping doesn’t have to scary, even to the least mathematically-minded individuals. While books do help you to see where your finances are, the mechanics of bookkeeping don’t require a financial analyst.

And if you have a smart accounting software on your team, bookkeeping will be a breeze.

Author profile

This guest post was written and provided by Jaren Nichols, Chief Operating Officer at ZipBooks, free accounting software for small businesses. Jaren was previously a Product Manager at Google and holds an MBA from Harvard Business School.

Jon Dykstra is a six figure niche site creator with 10+ years of experience. His willingness to openly share his wins and losses in the email newsletter he publishes has made him a go-to source of guidance and motivation for many. His popular “Niche site profits” course has helped thousands follow his footsteps in creating simple niche sites that earn big.

Pure quality content lad ! Opening my eyes to new markets.